Published 12 Nov, 2018

TENTacle on how to capitalise on the Fehmarnbelt Fixed link investment

Once completed, the Fehmarnbelt Fixed link (FBFL) will be an important part of the Scandinavian-Mediterranean (Scan-Med) TEN-T core network corridor. It is envisaged that the planned tunnel for road and rail transport reduces the transit time between Rødby on Lolland and Puttgarden on Fehmarn to seven minutes by train and ten minutes by car. As of 2018, the tunnel is expected to be opened in 2028.

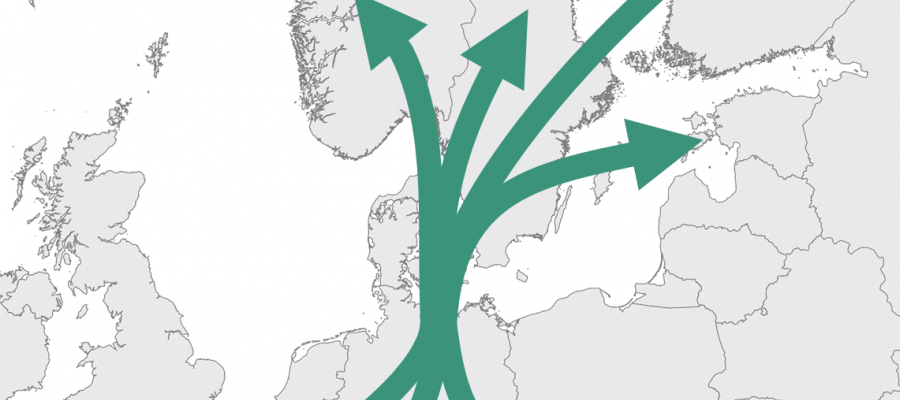

The TENTacle Pilot Case looked at the forecasted effects of the future FBFL investment on the Scan-Med Corridor for the routing of freight flows and - consequently - for the business models of the transport and logistics industries (incl. ports) in the impact area of the fixed link. This report covers the impact area of the FBFL investment, understood as the territory along the Scan-Med Corridor axes from Copenhagen in the direction of Hamburg and Berlin. It contains a summary of results of the conducted analyses, studies and stakeholder interfacing process within the Pilot Case. It also includes place-based measures addressing the development measures, both in the direct fixed link area and in the more distant parts, which might see negative flow displacement effects (e.g. loss of supply chains and outflow of production and service companies to better accessible locations).

A survey addressed to relevant companies and institutions – public and private – was conducted to learn more on anticipated challenges and/or possibilities caused by the FBFL. Target groups of the survey were (cargo) transport and logistics service providers/operators incl. ports, local/regional administrations/authorities, and business support organisations located in the future Fehmarnbelt catchment area of Northern Germany, Eastern Denmark and Southern Sweden. The survey shows that although each stakeholder is unique in its logistics strategy and that infrastructure measures are part of a large set of parameters influencing logistics choices, some similarities arise, especially within the clusters. It also indicates that the involved entities from the private sector in general do not consider new transport possibilities until the link is in operation or shortly prior to that. Although around 50% of the feedback was positive, the “opinion positive” is also often a political decision seen in an overall context that contains many “but”. The most deciding factor mentioned by all stakeholders is the final price of the tunnel. Especially stakeholders who are in general not content with the FBFL fear an unfair advantage due to state subsidies.

The traffic modelling performed for the TENTacle Fehmarnbelt pilot case by the ISL largely confirms the results of the stakeholder interaction process. Both show that the future price of the tunnel is the decisive variable, particularly for the very cost-sensitive cargo sector. Therefore, the actual amplitude of shifts cannot yet be forecasted precisely. However, the route choice calculations show which transport routes will see an increase of traffic and which ones will see a decrease. This helps identifying the changing transport flows in the hinterland and hence the potential impact in different regions and modes of transport. The most direct and unambiguous change is the shift of existing rail traffic from the Jutland route to the FBFL. Regarding the competition between the new fixed link and the existing ferry services, the studies find that passenger traffic will see much stronger shifts than cargo traffic. Furthermore, they that those shifts most strongly affect the nearby ferry routes Puttgarden-Rødby and Rostock-Gedser.

The relatively low level of replies from the surveys and personal interaction with stakeholders suggests that more stakeholder involvement and dissemination is required until the actual opening of the FBFL. Particularly small- and medium-sized companies must be included in the activities of, for example, cluster and business support organisations. Actual implementation of recommendations must be initiated by the stakeholders themselves, though. Support measures (e.g. EU regional funding programs) are available if needed.

The following best-practice examples in the Fehmarnbelt region are summarised in this output:

- Three studies on the effects of the FBFL on the Region Rostock and the business of the port for the three defined cargo groups: paper and forest products, agriculture products and products from the steel industry sector

- Accumulated experiences on how to benefit from the FBFL for regional development in Guldborgsund Municipality

- Further examples from: KielRegion as regional planner and business support organisation and stakeholders from the Port of Lübeck as a port authority and terminal operator

- Lessons learned from three past infrastructure projects: Oresund Bridge, Brenner-Base-Tunnel and Amsterdam Shiphol airport

In all the above examples, stakeholder involvement was started at an early stage of the planning process in order to take the caveats, but also the local knowledge into account. Most of the examples also conclude that the interaction process should go beyond the final approval of the infrastructure construction. If stakeholder involvement is regarded as a bothersome but necessary means to ‘push through’ an infrastructure project, its true potential is not used.

This report is the final output of the Fehmarnbelt Pilot Case which consists of representatives from Guldborgsund Municipality (DK), Rostock Port (DE), the Institute of Shipping Economics and Logistics (DE) and Port of Hamburg Marketing (DE). Individual reports by each project partner can be found in the download section of the TENTacle website. The full report can be downloaded here.

For more information please contact:

Inga Gurries

Port of Hamburg Marketing

gurries@hafen-hamburg.de